In the first half of 2016, significant office supply was introduced to the market. After the introduction of TNR Tower (grade A) in Q1 2016, two new grade B offices Handico Tower and 789 Tower came on stream in Q2 2016.

With these two newly introduced buildings, the West continued to be the supply hub with nearly 523,000 sqm, accounting for 45% of total supply. This will put further pressure on rents in this area since there will be more options for tenants. By the end of H1 2016, total office space in Hanoi reached approximately 1,169,000 sqm, in which Grade A and Grade B account for 36% and 64% respectively.

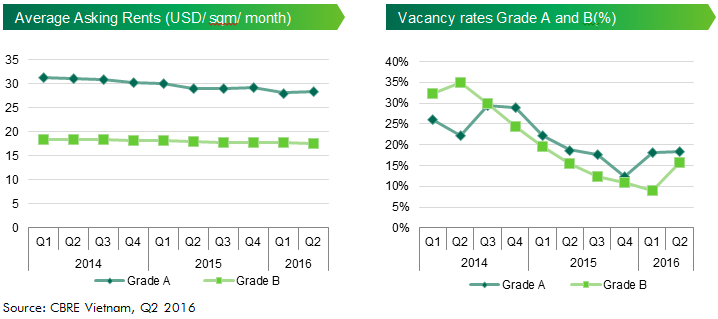

Demand wide, net absorption was only around 16,700 sqm in Q2 2016. With recent new supply, vacancy of grade B was pushed up whilst that of grade A slightly improved. Specifically, in Q2 2016 Grade A buildings vacancy decreased by 0.6 ppts q-o-q to 17.7%. Meanwhile, that of grade B went up by 6.18 ppts reaching 15.8%. By sector, banking, finance and insurance was the most active industries in Hanoi market in the first half of 2016 based on CBRE’s enquiries. Besides, whole floor plate with large area was hard to find in the CBD since supply is limited. Only 8 Grade A building had available floor plate greater than 500 sqm and only 3 of them were located in the CBD.

During the review quarter, Hanoi office market saw no significant change in asking rents compared with those of previous quarter. In particular, average asking rents of grade A went up by 0.5% q.o.q, achieving USD28.2 while those of grade B decreased by 0.6% q.o.q staying at USD 17.7.

Looking forwards, large-scale office buildings are being actively fitted out for launch, which will add up both grade A and B stocks. This will put downward pressure on rents, especially grade B office space since 72% of new supply in the next 3 years is felt under this grade. Despite the forth-coming supply, asking rents in mature buildings in good location with quality asset management services should maintain good performance as demand for those buildings remains high.

Source: http://www.cbrevietnam.com/